In order to tackle climate change, a successful transition from fossil fuels to clean energy is of vital importance. It is estimated that CO2 emissions must decline by around 25% by 2030, from 2010 levels, and reach net zero by around 2070 (Intergovernmental Panel on Climate Change, 2018), if global warming is to stay below 2 °C.

One promising source of clean energy is through hydrogen. Analysis by the International Renewable Energy Agency (IRENA) shows that a 6% hydrogen share of total final energy consumption by 2050 could be achieved, with the Hydrogen Council in its roadmap suggesting that an 18% share can be achieved by 2050 (International Renewable Energy Agency, 2019). The demand for hydrogen technologies is also already notable; for example, the use of renewable hydrogen as a means to decarbonise industry and energy generation is supported by legislative bodies such as the European Commission (European Hydrogen Bank, 2023).

However, policy and legislative changes are not enough to see hydrogen technologies scaled-up into a workable solution. Technological improvements are necessary in order to make low-emission hydrogen technologies more cost-competitive, and such improvements may take time and money to establish (for example, during prototyping and market entry phases). With this in mind, plenty of inventors use the patent system to minimise risk and ensure that their investments bear fruit.

As part of a joint study between the European Patent Office (EPO) and the International Energy Agency (IEA), the EPO has published an analysis of global patenting trends for hydrogen technologies. The key findings of this report are analysed below.

Overall Global Trends

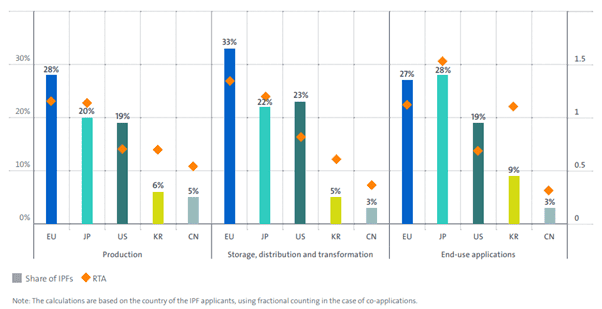

As can be seen from Figure 1 below, global patenting in hydrogen technologies in the period 2011-2020 was led by Europe and Japan. In addition, approximately half of the international patent families (IPFs) filed in hydrogen technologies during this period were related to hydrogen production. The remaining IPFs can be split between end-use applications of hydrogen and technologies for the storage, distribution, and transformation of hydrogen. The report also discusses the relative revealed technology advantages (RTAs) for each jurisdiction, which act as an indicator of a jurisdiction’s specialisation in a given technology. The report notes that European jurisdictions appear to be global leaders for hydrogen technologies, given that EU countries account for 28% of all IPFs in this technology between 2011-2020 and have high RTAs across each of the three technology segments.

Figure 1: Share of international patenting and revealed technology advantage by main world regions and value chain segments (European Patent Office, 2023)

Hydrogen Production

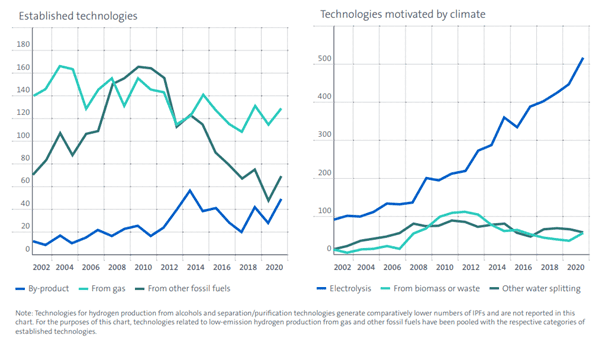

The EPO’s analysis indicates a shift in development from carbon-intensive methods to new technologies intended to decarbonise hydrogen production; as shown in Figure 2, technologies motivated by concerns around climate change generated nearly 80% of IPFs related to hydrogen production in 2020. Published IPFs related to hydrogen production from fossil fuels have been decreasing since 2007, with emerging solutions to decarbonise fossil fuel-based hydrogen generating only limited patenting thus far. In addition, patenting activities in hydrogen production from biomass or waste (for example, via gasification or pyrolysis) rose sharply between 2007 and 2011 but have decreased considerably since then. The number of IPFs related to water splitting via non-electrolytic routes has also decreased slightly since 2010. In 2020, it represented 12% of the total number of IPFs published in the field of electrolysis.

Figure 2: IPF trends in hydrogen production technologies, 2001–2020 (European Patent Office, 2023)

Accordingly, this analysis suggests that patenting of hydrogen technologies has already seen a major shift from traditional, carbon-intensive methods towards alternative, low-emission methods. However, the sharp increase in patenting activity related to climate-motivated hydrogen production technologies over recent years appears primarily driven by developments in electrolysis, with other low-carbon solutions such as hydrogen production from biomass or waste and water-splitting via non-electrolytic routes seeing less activity. These technologies may therefore be being overlooked in the wider, holistic approach to decarbonising hydrogen production.

Hydrogen Storage, Distribution and Transformation

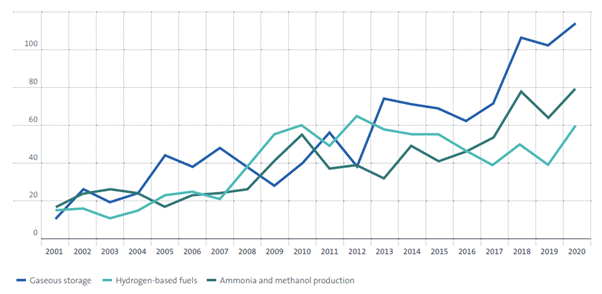

As can be seen in Figure 3, patenting activities targeting improvements in existing technologies for the storage of hydrogen and the production of ammonia and methanol grew steadily from 2001 to 2020. The EPO attributes the growth in the number of published IPFs related to the use of hydrogen for ammonia and methanol production to have two root causes: efforts to reduce the significant climate impact of these production processes, and recent interests in these molecules as hydrogen-based fuels for the power and transport sectors. Patent filings for other hydrogen-based fuels (for example, synthetic kerosene or synthetic methane) also rose over this period, however these filings only represent a small number of patent families. These filings also did not rise to the same extent as those for storage of hydrogen and the production of ammonia and methanol, and mostly originated from science-oriented research institutions.

Figure 3: International patenting trends in gaseous hydrogen storage, ammonia production, methanol production and alternative hydrogen-based fuels (IPFs, 2001–2020) (European Patent Office, 2023)

End Use Applications

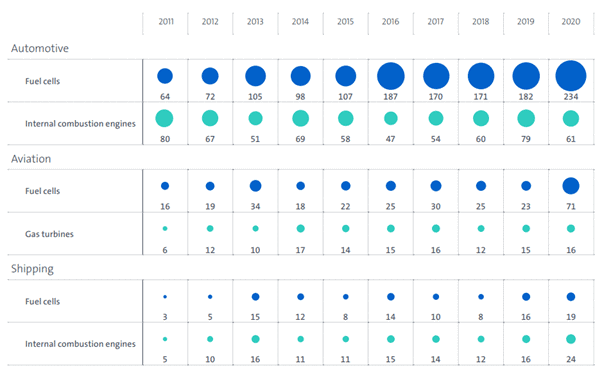

Figure 4 below clearly shows an expansion in patent activities for hydrogen use in the automotive sector over the period 2011-2020. The EPO attributes this strong growth to innovation in fuel cell propulsion in the automotive sector and, to a lesser extent, short-distance aviation (for example, drones). In contrast, innovation in internal combustion engines (ICE) and turbines using hydrogen, ammonia or methanol as a fuel has not seen the same levels of growth, despite being likely to be needed for long-distance transportation such as shipping and medium-haul aviation.

Figure 4: International patenting trends in hydrogen-based propulsion technologies, 2011–2020 (European Patent Office, 2023)

Moving away from propulsion technologies, IPF publications related to the use of hydrogen for iron and steel production rebounded in 2017 following several years of decrease since 2014. Furthermore, the level of patenting of other end-use applications of hydrogen in buildings and electricity generation decreased during the 2010s; this may indicate a lack of interest in building applications in regions other than Japan and demonstrate a growing interest in batteries as an alternative solution for stationary electricity storage.

Patenting and Start- Ups

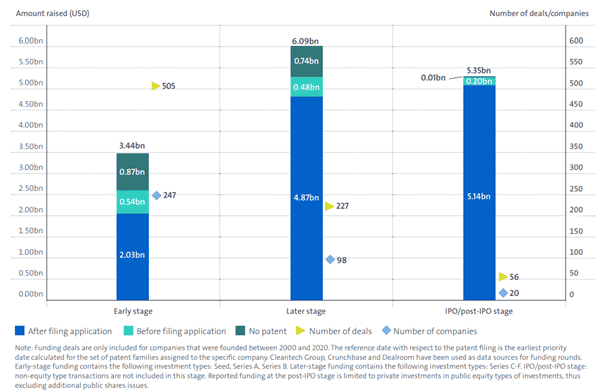

Finally, a noteworthy finding of the EPO’s analysis is that almost 70% of the 391 start-ups which have activities related to hydrogen hold at least one patent application. Only 117 of the 391 start-ups filed IPFs in the scope of the EPO’s analysis during the period 2011–2020, but these start-ups were found to have attracted 55% of the venture capital funding provided for early, late, and IPO/post-IPO stages. As shown in Figure 5, this disparity only grows when moving onto later funding rounds. More than 80% of the later-stage investment in hydrogen start-ups is received by companies which had already filed their first patent application, with this percentage increasing to 95% when funding acquired in the IPO/post-IPO stage is taken into consideration.

Figure 5: Share of funding accruing to start-ups, by funding stage, 2000-2020 (European Patent Office, 2023)

From this, it can be seen that the importance of patenting for young start-ups developing hydrogen business should not be understated, at least for the reason that the presence of a patent portfolio for a start-up can be a useful tool in obtaining funding.

Conclusions

Ultimately, the growth in patent filings in hydrogen tech forms the basis for a promising basis for scaling-up these technologies. Patent filings also appear to be providing notable benefits to start-ups and smaller companies in the hydrogen sector. However, uneven trends in patenting across different hydrogen-related technologies may slow the implementation of the technology chain as a whole, given the essential links between these different areas.

References

European Hydrogen Bank. (2023, April 21). Factsheet – European Hydrogen Bank. Retrieved from Official Website of the European Commission: https://ec.europa.eu/commission/presscorner/detail/en/fs_23_1610

European Patent Office. (2023). Hydrogen patents for a clean energy future: A global trend analysis of innovation along hydrogen value chains. Munich: European Patent Office.

Intergovernmental Panel on Climate Change. (2018). Special Report on Global Warming of 1.5 °C. Geneva: Intergovernmental Panel on Climate Change.

International Renewable Energy Agency. (2019). HYDROGEN: A RENEWABLE ENERGY PERSPECTIVE. Abu Dhabi: International Renewable Energy Agency.

This is for general information only and does not constitute legal advice. Should you require advice on this or any other topic then please contact hlk@hlk-ip.com or your usual HLK advisor.