What is R&D tax relief?

The UK Government recognises that innovation and creativity are vital components for improving the UK’s performance, productivity, and competitiveness in the global market. In order to encourage and reward greater innovation in the UK, the Government offer research and development (R&D) incentives for both large companies and small and medium size enterprises.

R&D tax relief is a Corporation Tax relief that may reduce a company’s tax bill if the company is liable for Corporation Tax or, in some circumstances, may offer payable tax credits.

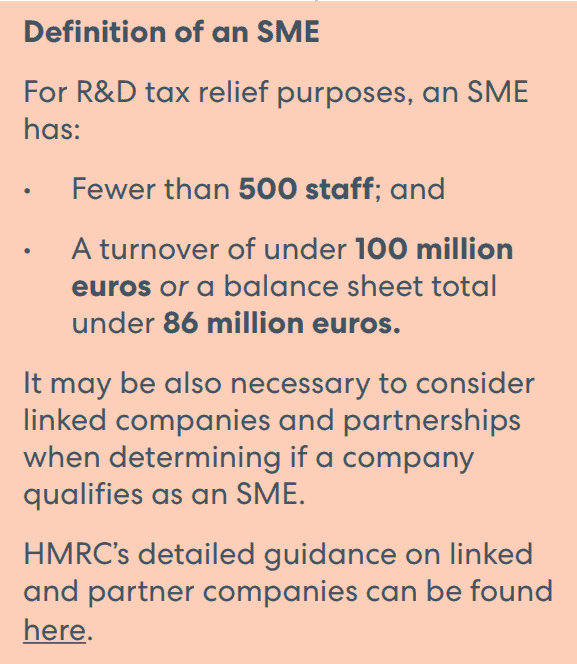

There are different types of R&D relief depending on the size of the company, the company’s R&D activities, and whether those activities have been subcontracted.

What qualifies as R&D?

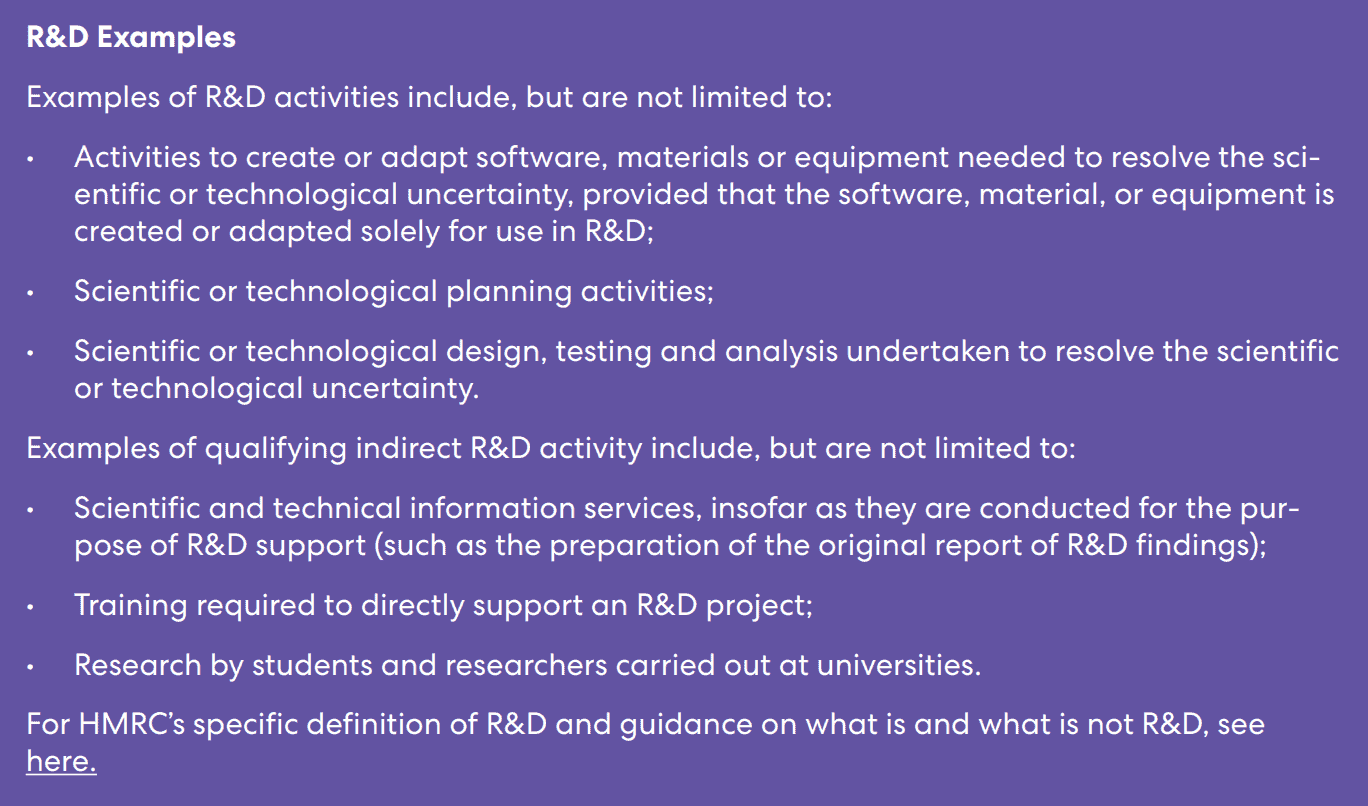

For tax purposes, R&D takes place when a project seeks to achieve an advance in science or technology – for all, not just for the business.

The activities that directly contribute to achieving this advance through the resolution of scientific or technological uncertainty qualify as direct R&D activities. Certain qualifying indirect activities related to the project are also R&D.

Activities (other than qualifying indirect activities) that do not directly contribute to the resolution of the project’s scientific or technological uncertainty are not R&D.

What tax relief is available?

Small and medium-sized enterprise (SME) R&D tax relief allows companies to:

- Deduct an extra 130% of their qualifying R&D expenditure from their yearly profit, as well as the normal 100% deduction, to make a total 230% deduction;

- Claim a tax credit if the company is loss making, worth up to 14.5% of the surrenderable loss.

Large companies can claim R&D expenditure credit (RDEC), which is currently calculated at 13% of the company’s qualifying R&D expenditure.

SMEs and large companies who have been subcontracted to do R&D work by a large company can also claim RDEC.

Are patent costs eligible?

The costs of preparing and registering a patent are not R&D — they are the costs of protecting the completed R&D. However, while you cannot receive R&D tax relief for the use and preparation of patents, patent protection is still important to consider when performing R&D.

For tax purposes, R&D must aim to create an advance in the overall field. For R&D tax relief, it is also necessary to show that a professional in the field could not easily work out the advance (for example, by showing that other attempts to find a solution had failed).

For patent purposes, it is necessary for an invention to be new and also that the invention involves an inventive step.

There are therefore clear parallels between what R&D qualifies for tax relief and what qualifies for patent protection. If making an R&D tax relief claim, companies should also consider applying for patent protection for any invention devised during the R&D. For patenting purposes, it is important to keep enabling details of inventions confidential before applying for patent protection: if you are in the early stages of R&D, HLK can advise on the best way to ensure that any disclosures are kept confidential.

Additionally, companies might also consider the Patent Box, which enables companies to apply a 10% rate of Corporation Tax to profits from patented inventions. See our guide to the Patent Box here.

This is for general information only and does not constitute legal advice. Should you require advice on this or any other topic then please contact hlk@hlk-ip.com or your usual HLK advisor.

A PDF of this information can be accessed here.