Development in medical technology (MedTech) has seen steady growth for at least the past decade. This growth has been driven in part by the ageing population and the need for technical solutions to ease the pressure on struggling healthcare systems around the world. Healthcare, health monitoring and treatment are now moving away from traditional realms where a patient is seen by a medical professional. Instead, new, innovative and cost-effective solutions are needed to supplement the more traditional solutions in order to meet the growing demand.

In our latest Analytics update, Andrew Flaxman from Haseltine Lake Kempner’s IP Analytics team looks at patent data in the MedTech field and considers where the future might lie for MedTech companies.

What is MedTech?

MedTech is a somewhat nebulous term which does not seem to have a single clear definition. For example, MedTech may include technology supporting the prevention of a condition, the diagnosis of a condition, monitoring a condition and its progress, the treatment of a condition and, more generally, the entire care pathway of a patient. Some definitions of MedTech include pharmaceuticals, such as drug compositions used to treat a condition, though pharmaceuticals are considered such a large sector in their own right, they fall outside the scope of MedTech for the purposes of this newsletter. Other definitions include computer processing techniques performed as part of a patient care system.

Our research was focused on patent applications that have been classified under any of a large set of classification headings[1] relating to various branches of medical technology.

MedTech is still on the rise

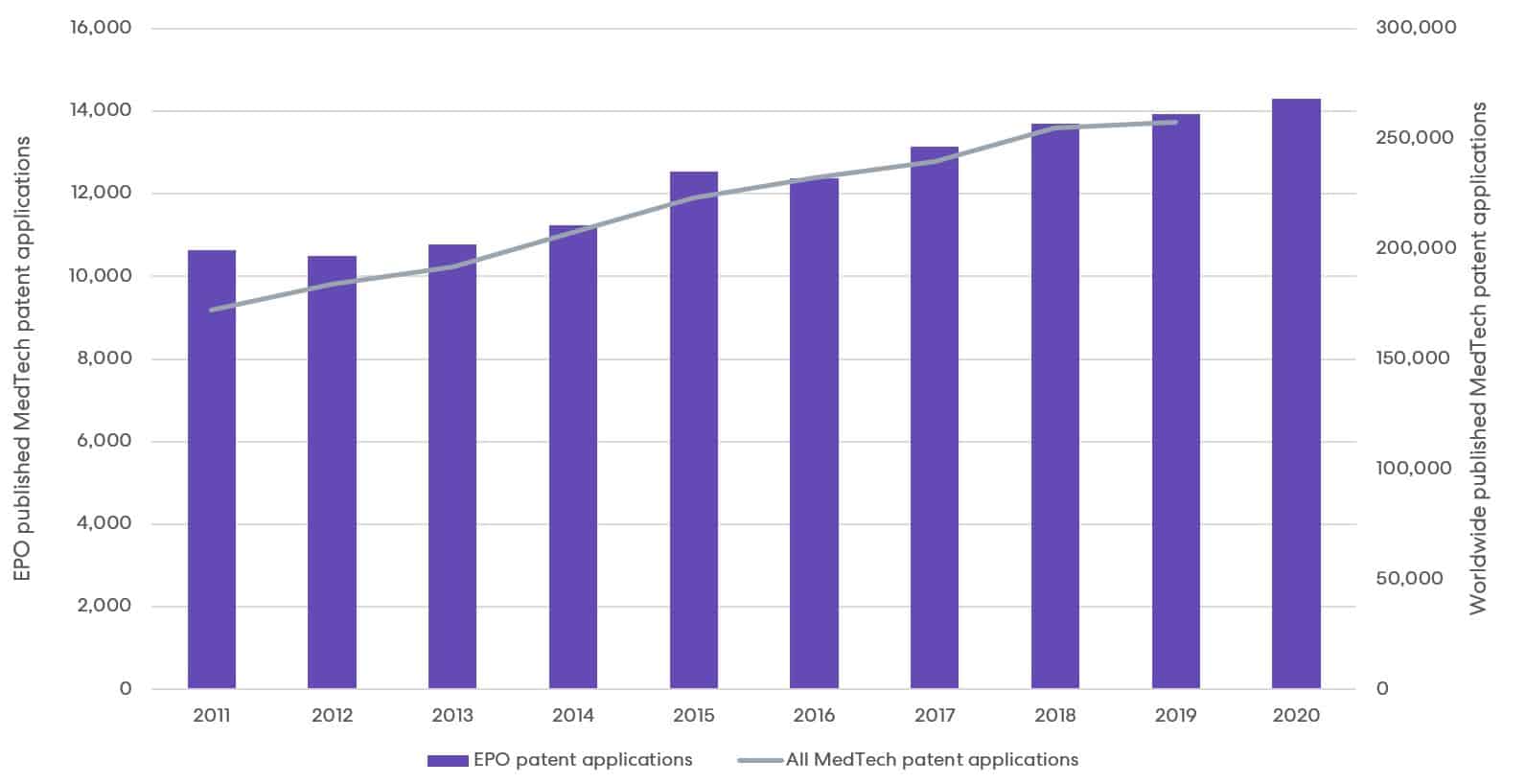

It is clear that innovation in medical technology is hugely important around the world. Our research shows a steady increase in the numbers of worldwide patent applications that have been classified under CPC headings relating to medical technology. The upward trend is echoed in data published by the European Patent Office (EPO), which shows year-on-year increases in MedTech patent filings at the EPO in seven of the last 10 years.

In total, since 2010, there have been around 2.3 million patent applications filed around the world in the field of MedTech, with around 1.5 million patents granted over the same period.

Patent applications filed in the field of medical technology at the EPO (purple bars) and patent applications published worldwide (grey line)

Our data covering all MedTech patent applications is incomplete for 2019 and 2020 due to patent applications remaining confidential until they are published 18 months after their filing date or priority date. That said, the incomplete data for 2019 shows an increase in patent filings in this field, and the EPO’s filing data shows continued growth, with a 2.6% year-on-year increase in the number of MedTech patent filings in 2020.

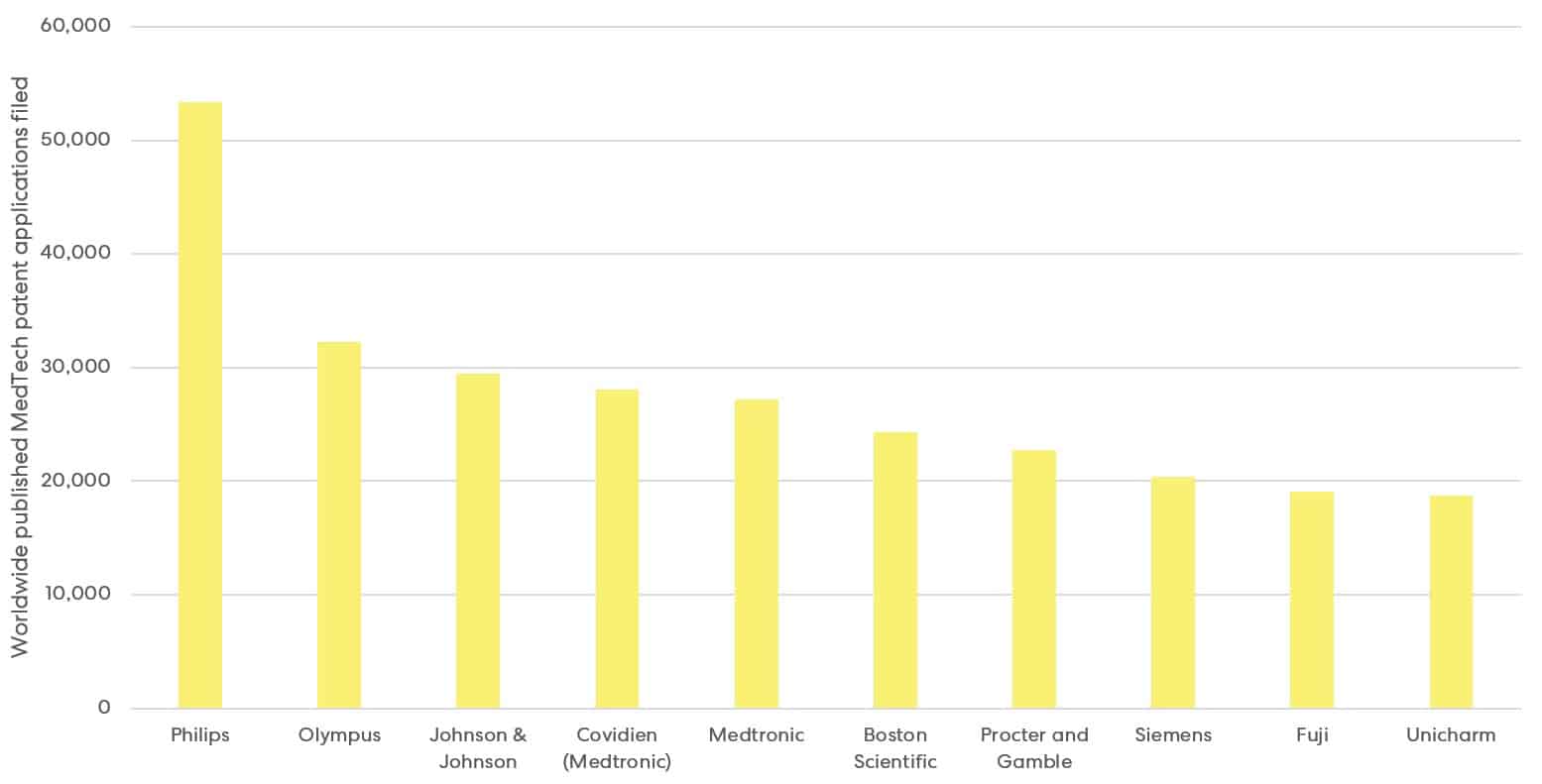

Looking at the applicants of MedTech patent applications, we see that many of top filers for this sector at the EPO are also top filers in the MedTech field around the world. Our data indicates that the companies named as applicants on the largest number of published MedTech patent applications worldwide are Philips, Olympus, Johnson & Johnson and Medtronic. Both Philips and Johnson & Johnson are also among the top overall applicants (9th and 14th, respectively) at the EPO in 2020.

Applicants with the largest numbers of published MedTech patent applications worldwide since 2010

Other applicants who make it into the top filers list in this sector at the EPO include Becton Dickinson & Company, Sanofi SA, Fresenius SE & Co., 3M Company and Edwards Lifesciences Corporation.

The COVID-19 Effect

The coronavirus pandemic has had a huge effect on industry across the globe. For some companies, R&D was forced to stop entirely while, for others, refocusing and a change of strategy led to R&D shifting into new areas, sometimes into the MedTech field. As a result, despite the impact of COVID-19, the 2020 data shows continued growth in the number of MedTech patent applications filed, while filing numbers in other sectors, such as transport, have declined. It will be some time until the pandemic’s full effect on industry can be known, but in 2020, the EPO have reported a reassuringly small year-on-year reduction (0.7%) in the total number of patent applications filed.

Changing the MedTech Field

While EPO patent application filing numbers have steadily increased over the past decade, this sector is by no means alone in its growth. The EPO reports an increase of 1.9% in patent applications falling within the Computer Technology field in 2020 and a 0.4% increase in patent applications falling within the Electrical Machinery, Apparatus and Energy field. Interestingly, several of the EPO’s top applicants in the MedTech field are also among the top applicants in these other fields. Samsung, for example, who rank 6th in the Electrical Machinery, Apparatus and Energy field and 11th in the MedTech field, are the EPO’s top filers in the Computer Technology field, while Philips rank 9th in the Computer Technology field and 3rd in the MedTech field.

It probably comes as no surprise that large companies such as Philips and Samsung are active in multiple sectors. However, there appears to be some overlap between activity in those sectors. In particular, some patent applications filed in the fields of Computer Technology and Electrical Machinery, Apparatus and Energy relate to technology used in the healthcare sector.

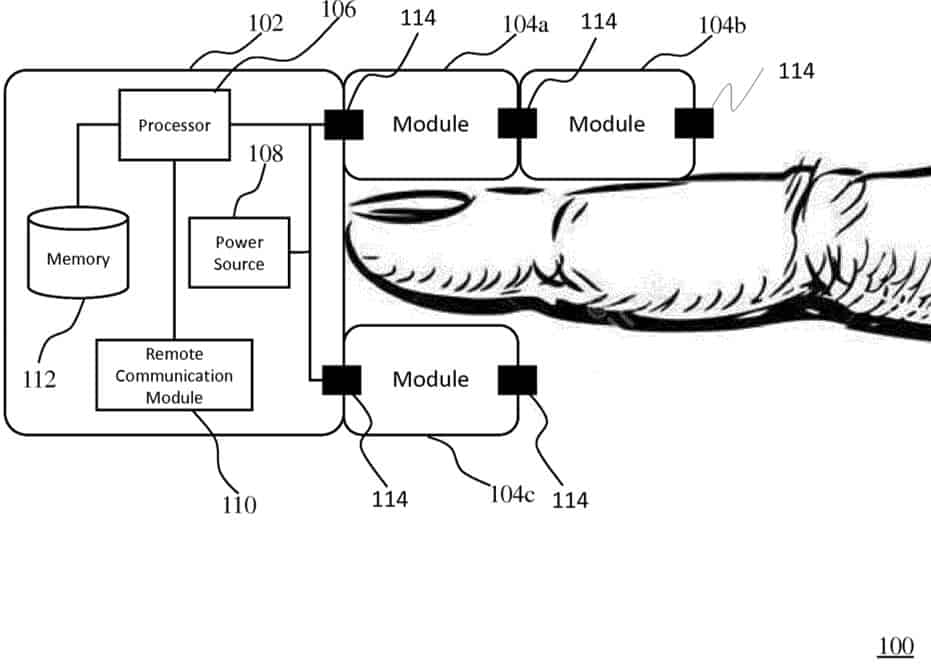

For example, EP3352657 (Philips) in the field of pulse oximetry relates to classic medical device technology, where a person’s oxygen saturation is measured using a finger-mounted pulse oximeter device, but the system also uses a complex computational algorithm to recognise modular devices connected to the pulse oximeter, and to operate the modular devices accordingly.

EP3352657 (Philips), Fig. 1

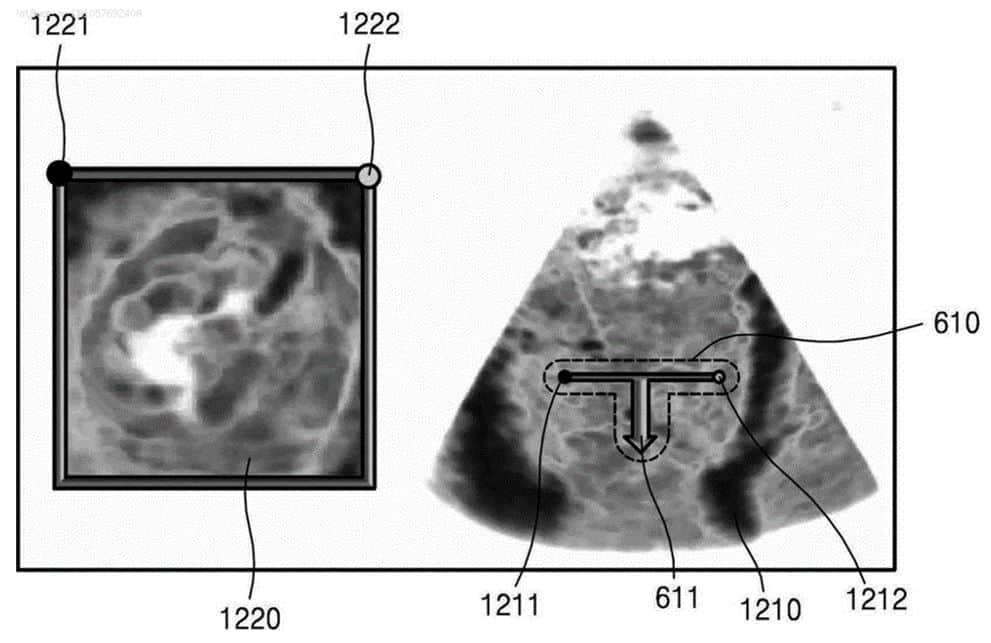

Another example is EP3042612 (Samsung), which relates to a method of displaying a medical image by rendering volume data of an object in a first direction and sub-volume data in a second, different direction. Both patent applications have been classified under A61B (medical diagnosis) and G06F (digital data processing) headings, so contribute to the MedTech and Computer Technology filing data at the EPO.

EP3042612 (Samsung), Fig. 12

Other areas where the crossover between Computer Technology and Medical Technology is becoming more apparent is in the field of artificial intelligence (AI). AI is increasingly being used for analysis of medical data, for example medical images, and the subsequent diagnosis of medical conditions based on the analysed data. Patent applications relating to such technology may be classified solely within the field of Computer Technology in light of the complex AI algorithms used, but the implementation of such technology may be solely in the medical field.

So, what does this mean for people working in MedTech? It is clear that the boundaries we use to define the various technology sectors are changing and beginning to merge with one another. For example, the crux of a “MedTech” invention may involve processing sensor data and using a machine learning algorithm to diagnose a medical condition based on the processed data. As we’ve seen, patent applications may straddle multiple fields and will therefore have to satisfy the patenting requirements relevant to inventions in those fields. For example, inventions involving AI may be objected to as relating to mathematical methods, and computer-implemented inventions may be objected to as failing to achieve a technical effect. Therefore, it is important to consider these potential pitfalls early in the patenting process – ideally when drafting the patent application – to put the applicant in the strongest position possible for securing patent protection.

Conclusion

The growth in MedTech patent applications has been strong over the past decade, and continued even during the start of the global COVID-19 pandemic. The move from traditional medical devices to more computer-based technology in the medical field suggests that some MedTech innovation may fall under different headings for the purpose of patent classification, and it will be interesting to see how the patenting trends in both of these fields develops over coming years. Data available next year, relating to patent filings in 2021, will begin to show us the true effect of COVID-19, when we might expect to see an overall reduction in filing numbers. How the filing data changes as a result of the changing MedTech landscape remains to be seen. In the meantime, the overlap between various sectors relevant to MedTech inventions means that the way we secure patent protection for these inventions is evolving, and patent applicants in the MedTech sector are finding that they need to overcome patenting issues that arise more commonly in relation to other sectors.

[1] Our search covered the following Cooperative Patent Classification (CPC) headings and their respective sub-headings: A61B (diagnosis, surgery, identification, including instruments, surgical tools, robots, and the like); A61F (filters implantable into blood vessels, prostheses, stents, bandages, dressings, and the like, including stents, contraceptive devices, nappies, prostheses); A61H (physical therapy apparatus, artificial respiration, massage, bathing devices for special therapeutic or hygienic purposes); A61J (containers specially adapted for medical or pharmaceutical purposes); A61M (devices for introducing media into, or onto, the body, including syringes, catheters, and the like); A61N (electrotherapy, magnetotherapy, radiation therapy, ultrasound therapy), G16H, G06F19 and G06Q (healthcare informatics) and H05G (x-ray technique)

IP Searching Services at HLK

At Haseltine Lake Kemper, our IP Analytics team have access to some of the world’s most comprehensive databases, allowing us to provide searching services to our clients. From trade mark searches to patent-based freedom-to-operate searches, we are able to offer a wide range of searching and analytics services, all provided by highly-skilled and experienced searchers, and all at competitive rates.

If you require a search in respect of any IP matter, or if you would like more information on any service provided by Haseltine Lake Kempner, please get in touch with your usual HLK contact.

Contact us

Andrew Flaxman

Partner

aflaxman@hlk-ip.com

David Hammond

Partner

dhammond@hlk-ip.com

Graham Lambert

Chief Operating Officer

glambert@hlk-ip.com