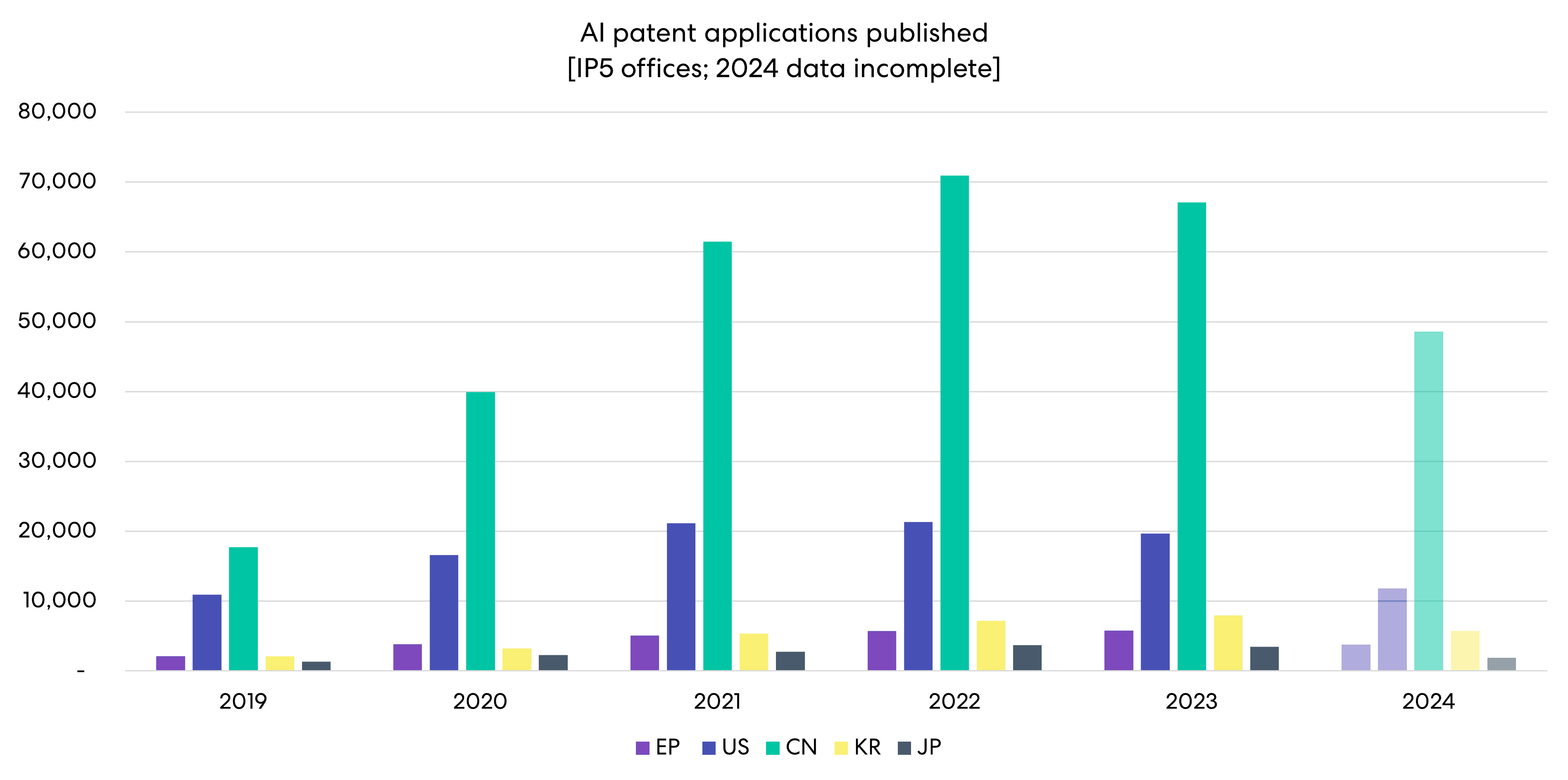

AI patent application publications

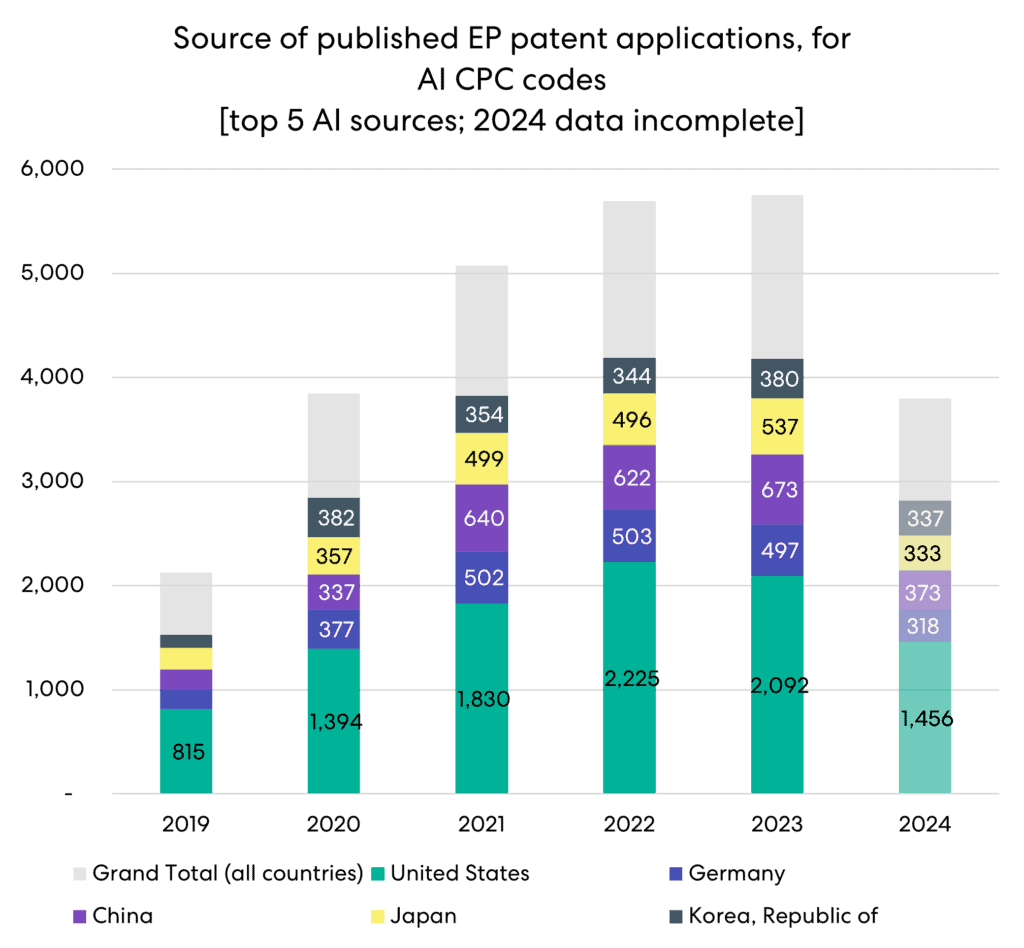

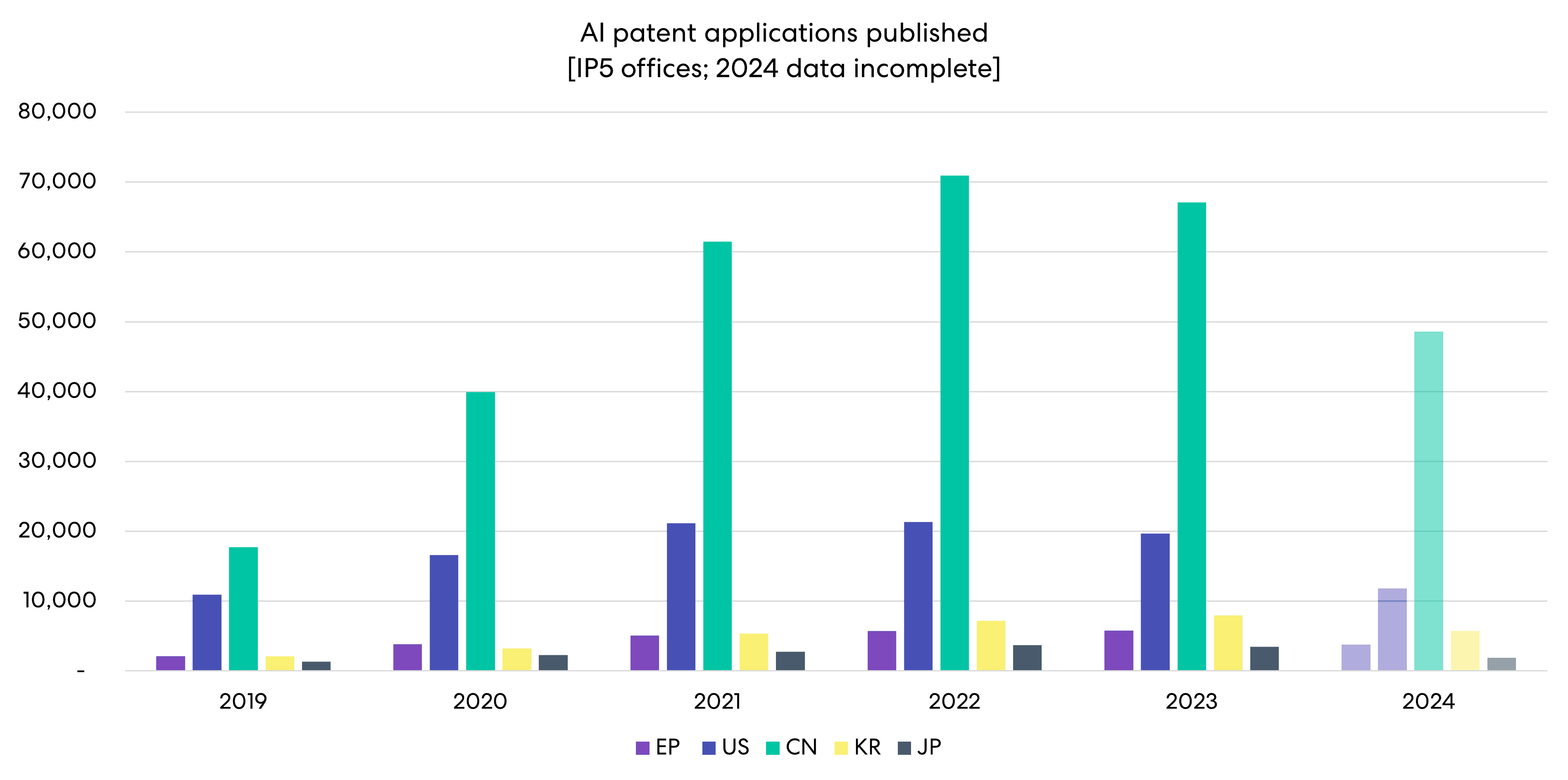

The below figure shows the absolute number of patent applications published by the IP5 patent offices (the EPO, USPTO, CN, KR, JP) since January 2019. This data (and that of all subsequent figures) is accurate up to 20th September 2024; hence, 2024’s data is incomplete.

Source: Lens (https://www.lens.org/)

In this period, there have been a total of over 480,000 AI patent application publications at the IP5 offices.

Perhaps unsurprisingly, China leads the way with a peak of just over 70,000 AI patent applications published in 2022 – this represented a 300% increase relative to 2019’s publications.

At the EPO, there have been a total of over 26,000 AI patent applications published since 1st Jan 2019, with 5,756 AI patent applications published last year (2023).

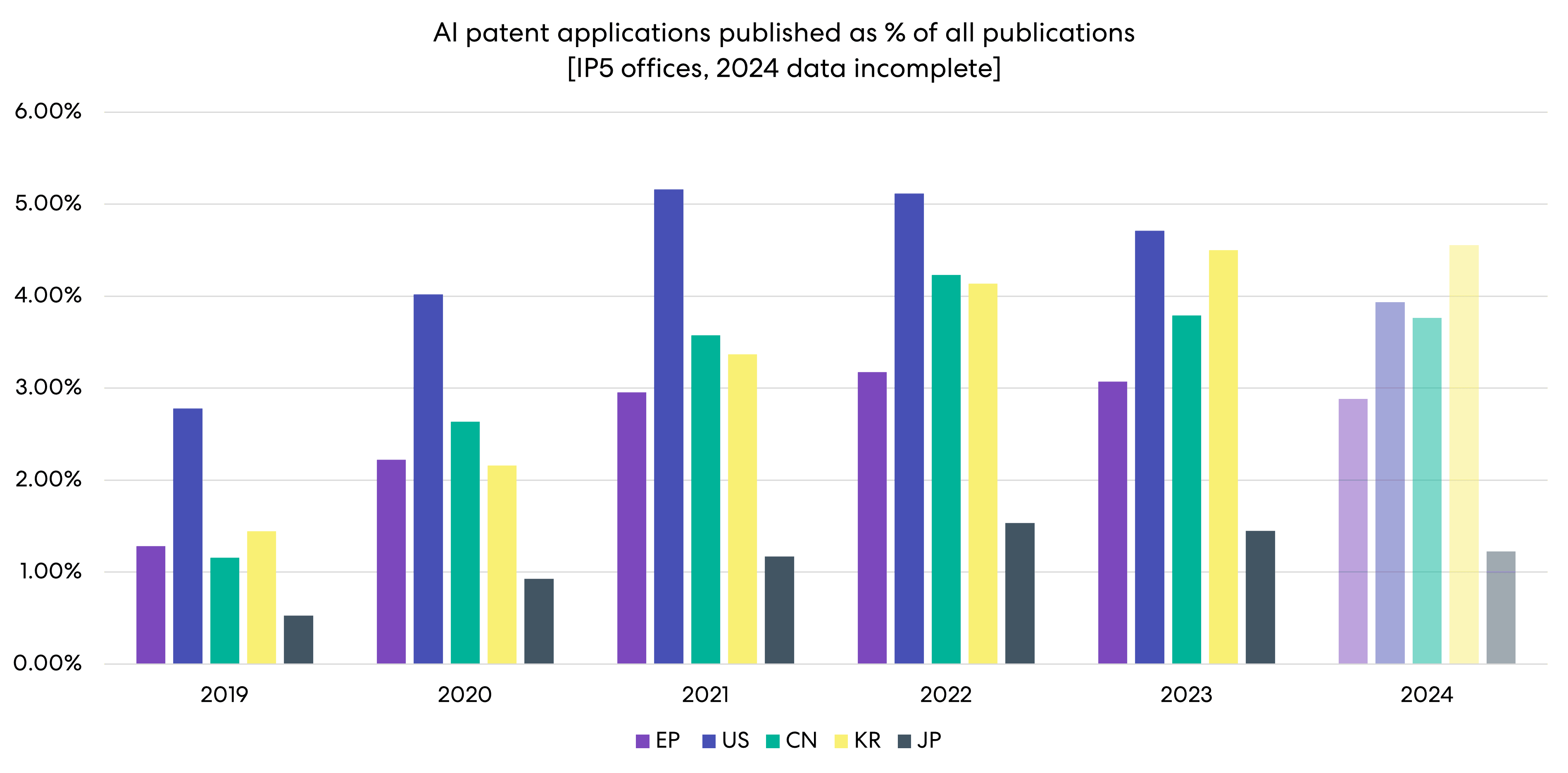

But how do these numbers compare to all patent application publications?

Source: Lens (https://www.lens.org/)

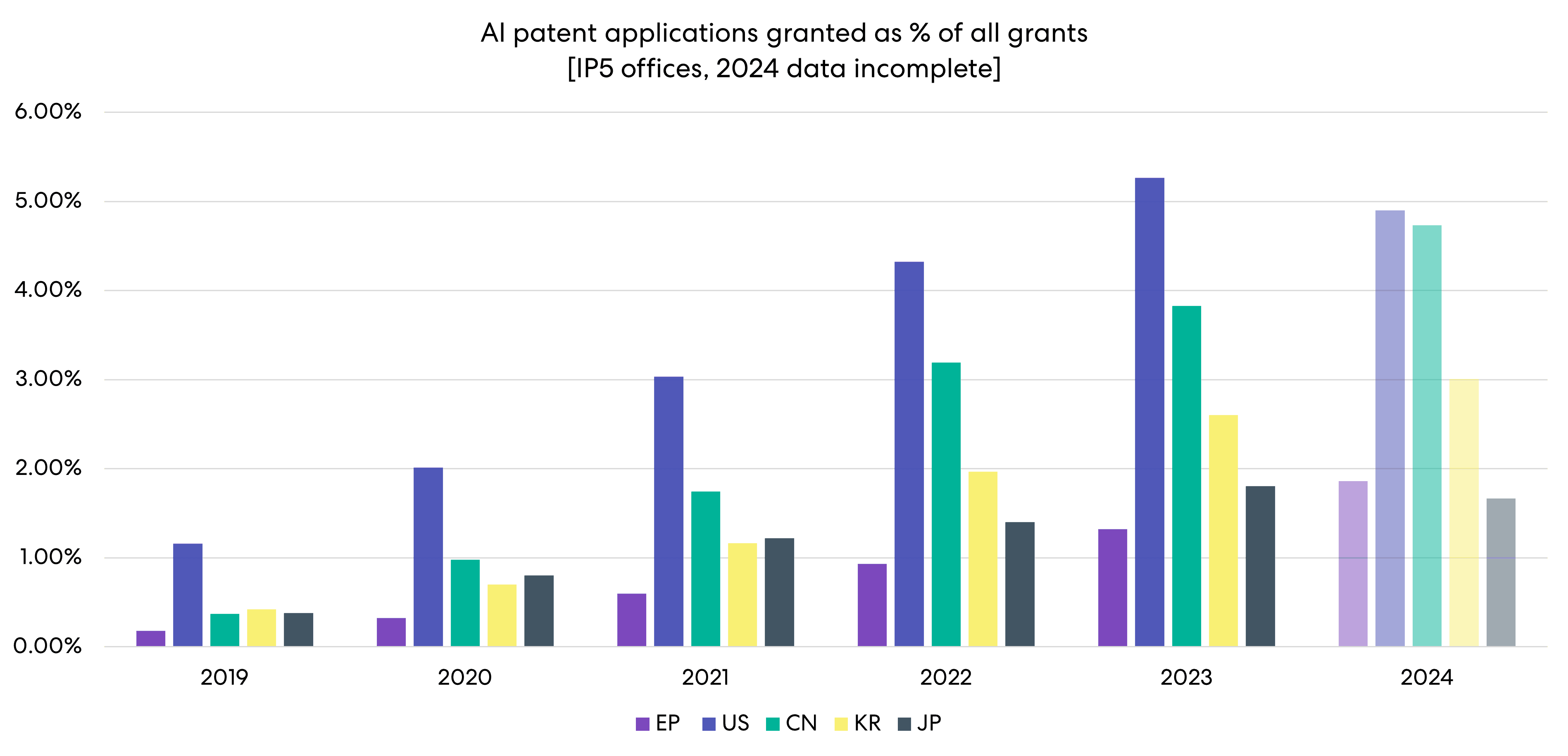

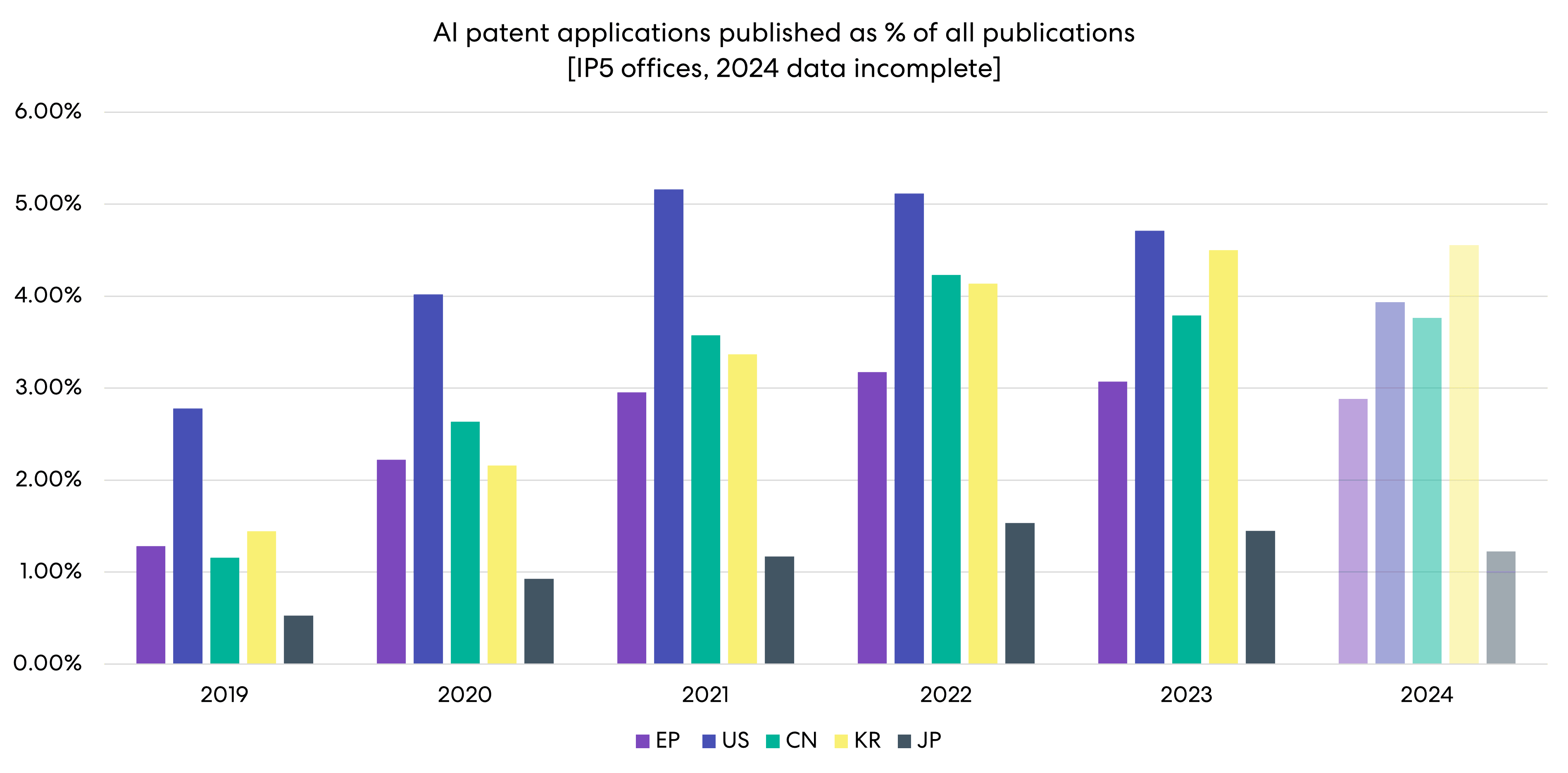

The above figure shows the share of AI patent applications published by the same IP5 patent offices, relative to the total number of all AI patent application publications.

Since January 2019, there have been just over 15,000,000 patent applications published (in all CPC classes).

Notably, until this year, the US has dominated in terms of the share of AI patent application publications, with around 5% of all patent application publications being AI related. Korea, however, looks to overtake the US by the end of 2024.

Perhaps surprisingly, Japan – despite the generous stance of patenting software and business methods – consistently publishes the fewest AI patent applications (both in terms of absolute numbers, and relative numbers as shown here).

At the EPO, relative AI patent application publication numbers rose steadily to around 3% in 2021 and have remained at this level ever since.